Cash Flow management is a core skill you need to master to be a successful business owner. It can drive growth, safeguard against uncertain times, and add profit to your bottom line.

Simply put, cash flow management is balancing the inflow and outflow of cash within a business. It encompasses money coming in from sales, investments and other sources, while also monitoring money going out for inventory, debt, and overhead. Profitability is the key metric to watch but good cash flow management keeps the business running. Projecting and managing cash flow in the short and long term is paramount in hitting your growth goals and planning for the future.

Cash Flow management is not just about survival it’s about your plan to thrive here’s why:

Fuel for Growth

Growth requires investment. Whether that’s scaling sales channels, investing in new product lines, or hiring more staff. The reinvestment of revenue in your business can be the difference of staying the same size or scaling year over year.

Safeguarding for Uncertain Times

Over the last few years in particular this has become more and more apparent. Having a nest egg to fall back on if there is a global pandemic, recession, supply chain issues etc has become increasingly more important. Businesses, especially ones like ours have seen wild swings in revenue and expenses over the last 4 years. Having a safety net will buy you time to navigate these unique challenges while keeping your doors open.

Timely payments make for good relationships

No one likes chasing people down for money. Keeping positive relationships with vendors and employees means paying when you agreed to. Making sure you’re tracking and planning for expenses will ensure a positive long term relationship. It can also buy you some goodwill in the rare situation where you cannot pay on time.

Decision Making

It’s impossible to 100% forecast the future. But 10 years into it we’re getting pretty good at it. Peter and I review cashflow on a weekly and sometimes daily basis. Making sure we’re hitting our revenue targets as well as making sure expenses are staying as budgeted. Having a plan for cashflow allows us to see when the right time is to push new product lines or increase marketing spend.

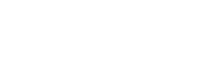

Cash Flow management is a continuous financial exercise. It can be as simple as a spreadsheet. It’s something that should be woven into the daily routine of someone in your company. It requires foresight, discipline, and agility to navigate the complexities of your small business finance. Profitability is your ultimate goal and cash flow is your GPS keeping you on course to your destination. By prioritizing liquidity, financial transparency, and forecasting, you can keep your company on course towards a long term resilient growing business.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.